Lindt & Spr眉ngli (OTCPK:LDSVF) ( OTCPK:COCXF) is a Swiss chocolatier and confectionery company founded in 1845, which, besides its namesake, also owns brands like Russell Stover and Ghirardelli. The company doesn't get as much coverage in the States as other U.S.-based chocolate companies like Hershey's (HSY), which is surprising given its stellar long-term performance.

The firm also operates a dual-share structure consisting of registered shares with voting rights (LISN:SW on the Swiss exchange), trading at a whopping 76,000 CHF as I write this, and cheaper (about 6,455 CHF) non-voting participation certificates (LISP:SW on the Swiss exchange). The chance of day traders and smaller investors messing around with shares, therefore, is relatively slim, and most holders will likely be institutional shareholders or investors in it for "the long haul", as pointed out by SA contributor Mark Dockray.

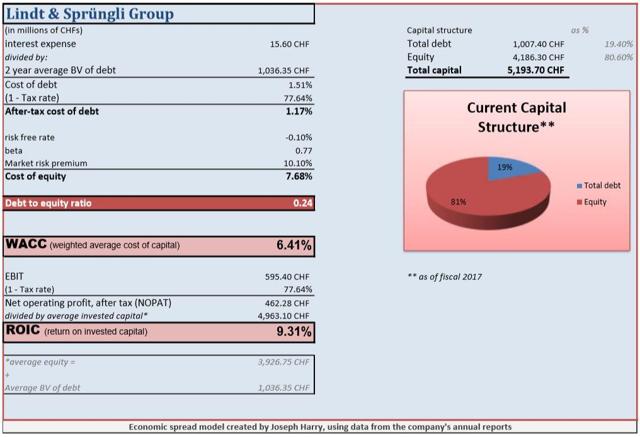

Return on invested capital analysisLindt operates a very conservative balance sheet in relation to more leveraged U.S.-based peers like Hershey.

The firm's debt-to-equity ratio of only about 0.24x compares to Hershey's ratio of over 3x. This appears to be part of the reason why ROIC is so much lower (HSY's ROIC frequently exceeds the 20% range). I also decided to adjust Lindt's weighted average cost of capital to account for a range of different equity costs, since the Swiss 10-year yield is negative (skewing the estimate of Lindt's cost of equity in my model above).

This doesn't strike me as a company that needs to constantly float equity to fund its operations, so I'd also assume the firm earns excess returns on its invested capital. That fact changes, however, if its cost of equity hits the 12% mark or higher, but that's probably irrelevant here.

This doesn't strike me as a company that needs to constantly float equity to fund its operations, so I'd also assume the firm earns excess returns on its invested capital. That fact changes, however, if its cost of equity hits the 12% mark or higher, but that's probably irrelevant here.

This is because the firm could easily buy back enough shares to shrink its equity with debt, coming closer to the capital structure of its peers (that utilize a lot more cheaper debt) to shrink its overall WACC - but then it would lose the benefit of its pristine balance sheet as well.

There are likely good arguments on both sides of this equation, but having more "balance sheet optionality" at the expense of having lower profitability ratios on paper isn't necessarily a bad thing in my opinion.

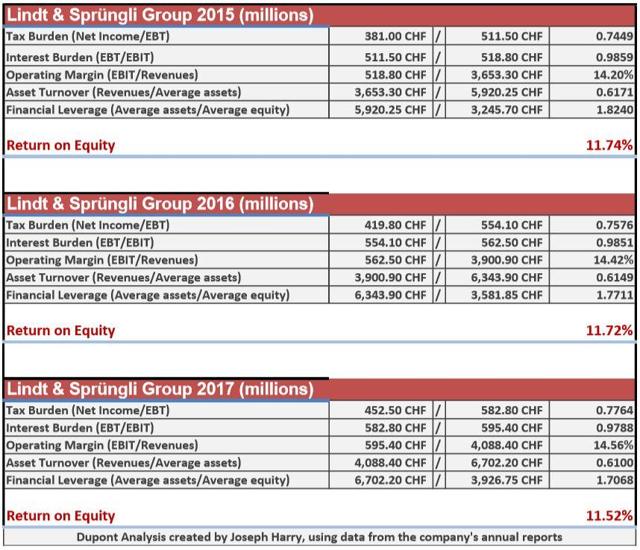

Return on equity analysisNext I will examine the firm's ROE by breaking it down into five pieces with the below Dupont.

The company's lack of leverage can once again be felt when looking at its sinking ROE. Despite the drop in ROE over the past three years, however, margins have expanded and asset turnover has only dipped by a few basis points.

The company's lack of leverage can once again be felt when looking at its sinking ROE. Despite the drop in ROE over the past three years, however, margins have expanded and asset turnover has only dipped by a few basis points.

If we set leverage at 1X for all three years and held everything else constant, "underlying" ROE would actually be sequentially higher - which tells me that the firm's capital allocation metrics could be understating the strength of the business in relation to peers due to the lack of magnification from more leverage. Both margins and asset turnover are lower than peers such as Hershey's, however.

In its annual report for fiscal 2017, Lindt also announced that:

Given the Group��s high liquidity, solid balance sheet and consistently high cash flow, the Board has decided to launch a buyback program worth up to CHF 500 million for registered shares and participation certificates. This program is scheduled to start on March 12, 2018 and will end no later than July 31, 2019.

Perhaps this will filter into better shareholder returns for fiscal 2018, and the company is guiding for continued expansion of its operating margins going forward as well.

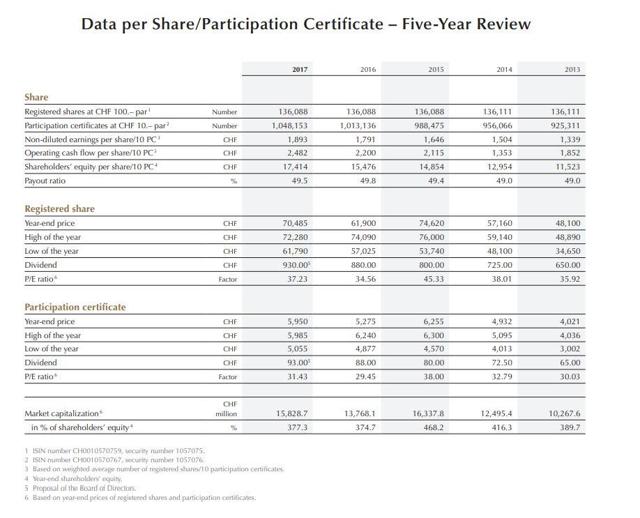

ValuationsMaybe because of the high share prices keeping speculators and non-long-term investors at bay, shares of Lindt almost always trade at a very premium price-tag.

Source: Lindt & Spr眉ngli 2017 annual report

Source: Lindt & Spr眉ngli 2017 annual report

The chance to purchase even the cheaper non-voting shares at below 30 times earnings is rare looking back five years. Shares are currently about 8.5% higher than the highs of fiscal 2017 as well.

ConclusionLindt is a perpetually pricey company that rarely ever goes on sale, and might make a good candidate to add to a "buy if there's a market crash" list. Otherwise, assuming the firm retains its premium valuations going forward like it has in the past, a good time to buy might be at the below 30 times earnings mark - and returns will likely follow earnings growth from there, I'd assume.

Due to the relatively large upfront investment needed to purchase just one voting share of the company, it's almost more of an investment in a private small business, and as the firm says in its annual report:

The successful pursuit of our commitments guarantees our shareholders an attractive long-term investment and the independence of our company. We wish to remain in control of our destiny. Independence through superior performance will allow us to maintain this control.

So far this strategy has worked, and there's a good chance it can continue to work if the company is able to continue to achieve its mid-to-long-term target of organic growth in the region of 6 to 8%, combined with a 20��40 basis point improvement in its operating margin.

If you enjoyed this article and would like to receive further updates and articles in the future, please feel free to hit the "Follow" button at the top of the page next to my name. For even more exclusive content, please consider a free two-week trial to my marketplace service, Harry's Retail Report.

Disclosure: I am/we are long HSY.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Articles I write for Seeking Alpha represent my own personal opinion and should not be taken as professional investment advice. I am not a registered financial adviser. Due diligence and/or consultation with your investment adviser should be undertaken before making any financial decisions, as these decisions are an individual's personal responsibility.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

No comments:

Post a Comment