The world of finance can seem boring to many people, and it's true that the thought of accounting rules, tax laws, valuation formulas, and inventory management systems might put you to sleep. But there's one concept in the financial realm that should have you sitting upright and paying attention, possibly even bubbling with excitement. That's the concept of compounding.

After all, what's more exciting than watching money grow? That's compounding at work, whether it's compound interest (as opposed to simple interest) or the compounded growth of stocks in a portfolio. Here's a comprehensive guide offering all you need to know about compounding.

Image source: Getty Images.

An introduction to compounding

Compounding comes in many forms, though it's the same principle at work in each. The easiest way to understand it is via the interest you earn in a bank savings account. The money you deposit at the bank can be borrowed and used by the bank, and for this privilege, the bank pays you interest. (It's the same when you borrow money -- you pay interest for the privilege.)

That interest can be paid on a simple or compound basis. Simple interest works like this: Let's say you deposit $1,000 in a savings account that's paying 10% interest. (Wouldn't that be nice!) That means you'll collect 10% of your deposit in interest each year. After one year, if you don't take any money out of the account, you'll have $1,100 -- your original balance of $1,000 plus 10% of it, which is $100. After two years, another $100 is added, for a total of $1,200. After 20 years, if the interest rate has been a steady 10%, you'll have your original $1,000 plus another $2,000. With a total of $3,000, you will have tripled your money in 20 years.

Fortunately, it's more common to receive compound interest, and that's far better. Compounding interest is essentially interest on top of interest. With compounding in the example above, not only will your account balance grow every year, but the amount by which it grows will also grow each year. Let's take a closer look at that: Imagine, again, that you start with $1,000 and earn 10% each year. (Hey, we can all dream, right?) After the first year, you'll have $1,100, because 10% of $1,000 is $100. But -- after the second year, you'll receive 10% of the $1,100, or $110, bringing your new balance to $1,210. (In the simple interest example, you would only have had $1,200 after two years.) Check out the table below to see the two kinds of interest at work:

After This Many Years

$1,000 Earning 10% Simple Interest

$1,000 Earning 10% Compound Interest

| 1 | $1,100 | $1,100 |

| 2 | $1,200 | $1,210 |

| 3 | $1,300 | $1,331 |

| 4 | $1,400 | $1,464 |

| 5 | $1,500 | $1,611 |

| 6 | $1,600 | $1,772 |

| 7 | $1,700 | $1,949 |

| 8 | $1,800 | $2,144 |

| 9 | $1,900 | $2,358 |

| 10 | $2,000 | $2,594 |

| 11 | $2,100 | $2,853 |

| 12 | $2,200 | $3,138 |

| 13 | $2,300 | $3,452 |

| 14 | $2,400 | $3,798 |

| 15 | $2,500 | $4,177 |

Data source: Calculations by author.

Clearly, compound interest is more lucrative and exciting. Take a closer look at how much the account grew by each year, with compound interest:

After This Many Years

$1,000 Earning 10% Compound Interest

Interest Added for the Year

| 1 | $1,100 | $100 |

| 2 | $1,210 | $110 |

| 3 | $1,331 | $121 |

| 4 | $1,464 | $133 |

| 5 | $1,611 | $147 |

| 6 | $1,772 | $161 |

| 7 | $1,949 | $177 |

| 8 | $2,144 | $195 |

| 9 | $2,358 | $214 |

| 10 | $2,594 | $236 |

| 11 | $2,853 | $259 |

| 12 | $3,138 | $285 |

| 13 | $3,452 | $314 |

| 14 | $3,798 | $346 |

| 15 | $4,177 | $379 |

Data source: Calculations by author.

Remember that with simple interest, you just gain the same $100 each year. But with compounded interest, your balance grows by $100 in the first year, $110 in the second year, and $379 in the 15th year. Your balance is snowballing, gaining value faster and faster. This is why compound interest is described as "interest on interest."

Image source: Getty Images.

Compounding periods

Compounding is actually not quite as simple as the examples above appear, because there's one more factor to consider -- how often the interest is compounded. The examples above reflect annual, or once-a-year, compounding, but compounding will often happen much more frequently than that. And as you might imagine, the more often compounding happens, the faster the growth. That's because each calculation is made based on the latest account balance, and if compounding happens monthly, the balance is slightly bigger each month, so the interest rate is applied to bigger and bigger sums each month.

The table below shows the difference the number of compounding periods can make. It reflects a $1,000 balance that earns 10% interest for 10 years.

Compounding Frequency

Number of Compounding Periods

End-of- Period Balance

| Annually | 1 | $2,594 |

| Semi-annually | 2 | $2,653 |

| Quarterly | 4 | $2,685 |

| Monthly | 12 | $2,707 |

| Daily | 365 | $2,718 |

| Continuously | infinite | $2,718 |

Data source: calculatorsoup.com.�

You can see how one's balance improves the more often compounding occurs, but the differences aren't always great. The difference between annual and quarterly compounding is significant, at $91, and the difference between the most and least frequent compounding intervals is even more meaningful, at $124. But results don't improve all that much when moving from monthly to daily compounding, and there's hardly any difference at all between daily and continuous compounding. The numbers in the table above seem identical, but they have been rounded up. There's actually a $0.37 difference between them.

[Helpful reminder: We'll soon be coming to some exciting stuff, such as how you can amass hundreds of thousands of dollars (or more!) and build a comfortable retirement.]

Compounding formulas

There's a little math behind what's happening with compounding. If this section makes your eyes glaze over or has you hyperventilating, feel free to move on to the next section.

Here's a look at how to calculate compound interest. The simplest way is probably to just take your starting balance and multiply it by the interest rate: $1,000 times 0.05 (for a 5% interest rate) gives you $50, which is 5% of $1,000. Add that to the starting balance, and your ending balance is $1,050, as we got in an earlier table. Now, for the next installment, multiply the $1,050 by 0.05 again, and you'll get $52.50. Add that to $1,050 and you'll get $1,102.50. And so on. This calculation method is simple, but it can still be a lot of work if you want many years of results. It can go much more quickly if you set up and Excel spreadsheet to do the number-crunching for you.

Another way is to use the compound interest formula. Here it is:

A = P (1 + r/n) ^ n*t

Here's what all the letters refer to: "A" represents the final amount in the account after "t" years, compounded "n" times at interest rate "r" with starting principal "P." (The * denotes multiplication.)

Let's run through an example. We'll start with $1,000 again and will earn 10% interest for 10 years, compounded quarterly. (Refer to the table above and you'll see that the answer, the final balance, should be $2,685. It's simply "A" in the formula as we begin. Our starting principal, "P," is $1,000. Our "r" and "n" that represent our interest rate and number of compoundings, are, respectively 0.10 and 40. The 0.10 is how we represent 10%, and 40 is because if you compound quarterly for 10 years, you will have 40 compounding periods. The "nt" exponent is the number of compoundings times the number of years, or 40 times 10, which is 400.

So, our formula is taking shape, and now looks like this:

A = $1,000 (1 + 0.10/4) ^ (4*10)

Refine it a bit and it becomes:

A = $1,000 (1 + 0.025) ^ (40)

And then:

A = $1,000 (1.025) ^ 40

And:

A = $1,000 (2.685)

Finally, we arrive at:

A = $2,685

That's the number we were hoping to arrive at, remember?

It's good that you now know how to calculate compound interest, but the good news is that you will rarely have to do so. There are, fortunately, online calculators that can do the work for you. There's an interest calculator at Fool.com, for example, and a fancier one at calculatorsoup.com.

Image source: Getty Images.

Behold, compounding tables

Here's another nifty tool for when you want to make sense of compounding: a compounding table! Check out the example below, which shows you what you'd multiply your starting balance by if it were going to grow at a certain rate for a certain number of years:

Year

2%

4%

6%

8%

10%

12%

15%

20%

25%

| 1 | 1.02 | 1.04 | 1.06 | 1.08 | 1.10 | 1.12 | 1.15 | 1.20 | 1.25 |

| 2 | 1.04 | 1.08 | 1.12 | 1.17 | 1.21 | 1.25 | 1.30 | 1.40 | 1.60 |

| 3 | 1.06 | 1.12 | 1.19 | 1.26 | 1.33 | 1.41 | 1.50 | 1.70 | 2.00 |

| 4 | 1.08 | 1.17 | 1.26 | 1.36 | 1.46 | 1.57 | 1.70 | 2.10 | 2.40 |

| 5 | 1.10 | 1.22 | 1.34 | 1.47 | 1.61 | 1.76 | 2.00 | 2.50 | 3.10 |

| 7.5 | 1.16 | 1.34 | 1.55 | 1.78 | 2.04 | 2.34 | 2.90 | 3.90 | 5.30 |

| 10 | 1.22 | 1.48 | 1.79 | 2.16 | 2.59 | 3.11 | 4.00 | 6.20 | 9.30 |

| 15 | 1.35 | 1.80 | 2.40 | 3.17 | 4.18 | 5.47 | 8.10 | 15.40 | 28.40 |

| 20 | 1.49 | 2.19 | 3.21 | 4.66 | 6.73 | 9.65 | 16.40 | 38.30 | 86.70 |

| 25 | 1.64 | 2.67 | 4.29 | 6.85 | 10.83 | 17.00 | 32.90 | 95.40 | 264.70 |

| 30 | 1.81 | 3.24 | 5.74 | 10.06 | 17.45 | 29.96 | 66.20 | 237.40 | 807.80 |

Data source: calculatorsoup.com.�

The table can quickly let you see that over, say, 20 years, a $5,000 investment will grow by a factor of 9.65 if it grows at 12%. In other words, the 9.65 is a multiplier. Multiply the $5,000 by it and you arrive at $48,250. If you had a bank account that paid 12% interest for 20 years, your initial $5,000 would turn into $48,250. (We're compounding annually in this example.)

The table can also offer some deeper insights. For example, if you know that you want to triple your money, you can look for the multipliers closest to 3.0. There are several. Growing your money at 12% for 10 years will increase your money by a factor of 3.11, for example, while growing your money at 8% for 15 years will give you a growth factor of 3.17. It would only take five years to triple your money if it were growing at 25% annually, but it's a tall order to find such a growth rate.

The rule of 72 -- compounding at its simplest

If your head has been spinning for a while now, know that there's an easy way to figure out how long it will take to double your money through the process of compounding: the rule of 72.

The rule of 72 tells us that if you divide 72 by an annual growth (or interest) rate, the result will be the number of years it will take to double your money. So, for example, if you expect a 10% annual return, divide 72 by 10 and you'll learn that it will take about 7.2 years to double your money. Note that this shortcut is fairly accurate much of the time, but not so accurate with high expected growth rates. For example, if you expect a 72% annual growth rate, the rule suggests it will take a year to achieve doubling, but doubling is an increase of 100%, not 72%.

Here's the rule at work in all its glory:

Growth Rate

Years to Double

| 2% | 36.0 |

| 3% | 24.0 |

| 5% | 14.4 |

| 7% | 10.3 |

| 10% | 7.2 |

| 12% | 6.0 |

| 15% | 4.8 |

| 20% | 3.6 |

| 25% | 2.9 |

Data source: Author calculations.

The rule starts getting rather imprecise at rates higher than the ones above. Even at 25%, it's meaningfully off, with the actual�number of years to double being 3.1. Still, the rule can be handy when you're looking for a rough idea.

The compound annual growth rate (CAGR), explained

Anyone very familiar with compounding should also understand what the compound annual growth rate, or CAGR, is. It's simply a measure that shows you the annual growth rate that's in effect when a number grows and becomes a bigger number over time. For example, imagine that you start with $1,000 (or 1,000 porcupines) and in 15 years, you have $2,000 (or 2,000 porcupines). How quick was that growth? Well, plug those numbers into a CAGR calculator and you'll see: 4.73% per year.

The CAGR can be useful for investors when they want to see the average annual growth rate of their investments over time. With a fixed-rate investment, the average is clear -- it's the fixed rate, each year, for however many years. But investments in, say, the stock market, can grow and shrink from year to year. In some years, the overall stock market has�advanced by more than 20% or even 30%, and in other years, it has gone even higher. (The long-term average annual growth rate of the stock market is close to 10%.) If you plot your portfolio's growth on a graph, it will likely be a jagged, zigzaggy line, but it will also have a compound annual growth rate.

Examples of compounding -- in stocks and elsewhere

Now that you've got the basics of compound interest and compounding in general under your belt, let's move away from bank accounts and interest and into more interesting realms, where growth can be even faster.

Think, for example, of a famous Faberge Organics shampoo commercial, which started one woman facing the camera and saying that she told two friends about the shampoo. The frame then splits in two, so we see two women. She then explains that "they told two friends," and the screen splits again, showing four women. This goes on and on, with each woman telling two friends and the screen quickly dividing and redividing, until there are 24 small frames, each with a woman holding a bottle of shampoo. That's an example of compounding, because in each round more and more women are being told about the shampoo, with the total number of women increasing by a growing amount each time.

Investing in stocks can offer a compounding effect, too. Remember that a share of stock is a share in an actual ongoing business (and, one hopes, a strong and profitable one). Ideally, the business will grow. Imagine that a company you're investing in, perhaps Scruffy's Chicken Shack (ticker: BUKBUK), is worth about $500 million and that it's growing in value by about 10% annually. Stock growth is much less predictable than savings account growth, but over long periods, stock in great companies does grow -- and historical market performance is around 10% annually over long time periods. Thus, if your $1,000 stake in the company grows by 10% annually, it will amount to around $2,590 after a decade. (I quickly used the compounding table above to help me get that sum.)

Many companies grow much faster than that, though it can be hard to identify which ones will before they do so, and it's often hard to be able to invest in them while they're still undervalued or reasonably valued. Still, check out these long-term growth rates, just to get an idea of what is possible in stocks:

Company

20-Year Average Annual Growth Rate*

$10,000 Would Grow to:

| Amazon | 31.39% | $2,358,010 |

| Apple | 31.03% | $2,232,035 |

| Starbucks | 17.01% | $231,850 |

| Altria� | 15.63% | $182,853 |

| Nike | 14.82% | $158,858 |

| Boeing� | 13.04% | $116,205 |

| Home Depot | 12.60% | $107,481 |

| Johnson & Johnson� | 9.03% | $56,407 |

| Clorox� | 8.23% | $48,678 |

| Walt Disney | 6.45% | $34,931 |

| PepsiCo | 7.04% | $39,016 |

Data source: theonlineinvestor.com,�author calculations.�*with dividends reinvested

Remember, too, that the overall stock market has averaged returns close to 10% annually, over very long periods. That's far more than bank accounts typically pay in interest, and it beats bond interest rates in most periods, too. There's no need to hunt for stellar stocks when you can just invest in the overall market via a low-cost broad-market index fund such as one based on the S&P 500.

Even superinvestor Warren Buffett has recommended index funds for most people: He says�that in his will, he offers these instructions for the money left for his wife: "Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard's.)" Many fund companies offer many index funds -- just be sure to choose one with low fees, as there are very low fees to be found. A particularly easy way to invest in the S&P 500 is via an exchange-traded fund (ETF) such as the�SPDR S&P 500 ETF Trust�(NYSEMKT:SPY). ETFs work much like stocks, letting you buy as many or as few shares as you want throughout the trading day. A SPY share recently traded for about $272 per share, sported a dividend yield of around 1.8%, and charged�just 0.09% in annual fees.

One last point about stocks and compounded growth: Many stocks reward investors not just with share-price appreciation but also with dividends. And with healthy, growing companies, those dividends are increased over time. Thus, if your holding is increasing in value on a compound basis by, say, 10% annually, it may also be paying out a 2% or 3% (or greater) dividend, and the amount it pays each quarter may itself be growing by 5% or 10% per year.

How compounding can make you rich

You're probably getting an idea by now of how compounding can make you rich. Let's look at some inspiring specific examples, though. The table below illustrates what a difference your money's growth rate can make, showing what annual investments of $10,000 can grow to:

Growing for

Growing at 4%

Growing at 8%

Growing at 10%

| 15 years | $208,245 | $293,243 | $349,497 |

| 20 years | $309,692 | $494,229 | $630,025 |

| 25 years | $433,117 | $789,544 | $1.1 million |

| 30 years | $583,283 | $1.2 million | $1.8 million |

Data source: Calculations�by author.

An annual average of 10% would be great, but the market won't necessarily deliver that over your specific investment period, so it's best to hope for, but not count on, such a hefty growth rate. Here's how your money will grow at a more conservative 8% annually, if you make annual investments of various sizes:

Growing at 8% for

$5,000 Invested Annually

$10,000 Invested Annually

$15,000 Invested Annually

| 10 years | $78,227 | $156,455 | $234,682 |

| 15 years | $146,621 | $293,243 | $439,864 |

| 20 years | $247,115 | $494,229 | $741,344 |

| 25 years | $394,772 | $789,544 | $1.2 million |

| 30 years | $611,729 | $1.2 million | $1.8 million |

Data source: Calculations by author.

As you might have noticed, you can actually become a millionaire over time, thanks to compounding. The critical key to doing so is to start saving and investing as early as possible -- or to sock away rather hefty sums annually over fewer years. It can be hard to get and stay motivated about retirement investing when you're only in your 30s, but those are the years in which you can invest extra-powerful dollars -- ones that can grow for you for decades.

How to put compounding to work for you

So how, exactly, should you go about putting compounding to work for yourself? Well, go ahead and enjoy compound interest in a savings account for your short-term money. CDs and bonds can also be good for that. With longer-term money, such as dollars you won't need for at least five, if not 10, years, it's hard to beat the stock market�as an investing vehicle.

You can enjoy growth and some tax breaks by using tax-advantaged retirement accounts such as IRAs and 401(k)s. Each of those comes in a traditional or Roth variety. With a traditional IRA or 401(k), you contribute pre-tax money, reducing your taxable income for the year, and thereby reducing your taxes, too. (Taxable income of $75,000 and a $5,000 contribution? Your taxable income drops to $70,000 for the year.) The money grows in your account and when you withdraw it in retirement, it's taxed at your ordinary income tax rate at the time -- which is often lower than your current rate.

With a Roth IRA or 401(k), you contribute post-tax money that doesn't reduce your taxable income at all in the contribution year. (Taxable income of $75,000 and a $5,000 contribution? Your taxable income remains $75,000 for the year.)�Here's why the Roth IRA or 401(k) is a big deal, though: Your money grows in the account until you withdraw it in retirement --�tax-free.

For 2018, the IRA contribution limit is $5,500 -- plus $1,000 for those 50 or older. 401(k) accounts enjoy far steeper contribution limits. For 2018, it's $18,500 plus an additional $6,000 for those 50 and up.

You can open IRA accounts at most major brokerages and many other financial services companies, and you can open and invest through regular, taxable accounts, too, through good brokerages. Don't limit yourself to retirement account contribution limits.

Albert Einstein is said to have referred to compounded growth as a "miracle," and it's not hard to see why. It's a phenomenon that can turn a single $100 investment into millions or even billions of dollars -- provided you have enough time. For most of us, it's best to work with lots of installments far greater than $100 and to aim for hundreds of thousands or millions of dollars. The math says you can do it!

BTC/USD (green denotes winning day)

BTC/USD (green denotes winning day)  Stock investors confront the once unthinkable: a new world order

Stock investors confront the once unthinkable: a new world order  Lawsuit against Navient can proceed �� why student loan borrowers should pay attention

Lawsuit against Navient can proceed �� why student loan borrowers should pay attention

D.R. Barton, Jr.

D.R. Barton, Jr. Syndicate (CURRENCY:SYNX) traded 2.3% higher against the US dollar during the 24-hour period ending at 16:00 PM ET on July 3rd. Over the last week, Syndicate has traded up 1.1% against the US dollar. One Syndicate coin can now be bought for approximately $0.16 or 0.00002386 BTC on exchanges including YoBit, Cryptopia, CoinExchange and Bittrex. Syndicate has a market capitalization of $3.08 million and $146,084.00 worth of Syndicate was traded on exchanges in the last 24 hours.

Syndicate (CURRENCY:SYNX) traded 2.3% higher against the US dollar during the 24-hour period ending at 16:00 PM ET on July 3rd. Over the last week, Syndicate has traded up 1.1% against the US dollar. One Syndicate coin can now be bought for approximately $0.16 or 0.00002386 BTC on exchanges including YoBit, Cryptopia, CoinExchange and Bittrex. Syndicate has a market capitalization of $3.08 million and $146,084.00 worth of Syndicate was traded on exchanges in the last 24 hours.

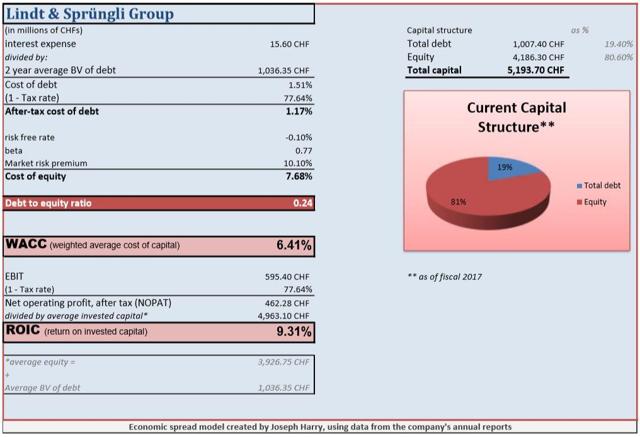

This doesn't strike me as a company that needs to constantly float equity to fund its operations, so I'd also assume the firm earns excess returns on its invested capital. That fact changes, however, if its cost of equity hits the 12% mark or higher, but that's probably irrelevant here.

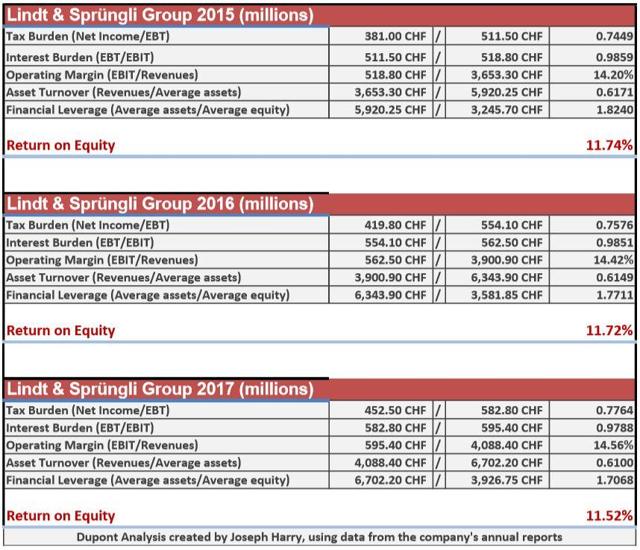

This doesn't strike me as a company that needs to constantly float equity to fund its operations, so I'd also assume the firm earns excess returns on its invested capital. That fact changes, however, if its cost of equity hits the 12% mark or higher, but that's probably irrelevant here. The company's lack of leverage can once again be felt when looking at its sinking ROE. Despite the drop in ROE over the past three years, however, margins have expanded and asset turnover has only dipped by a few basis points.

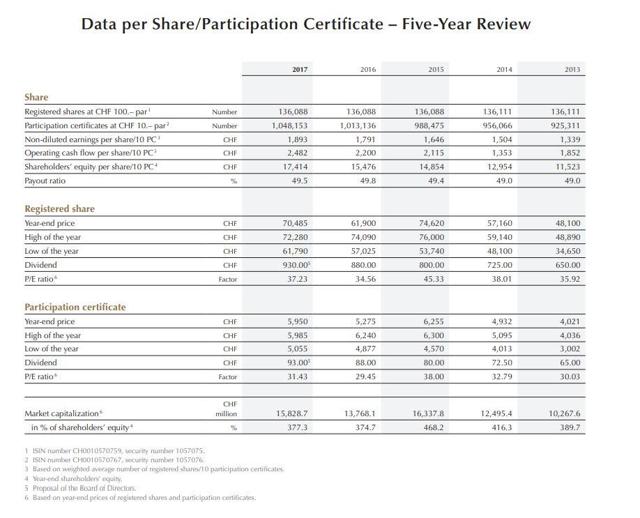

The company's lack of leverage can once again be felt when looking at its sinking ROE. Despite the drop in ROE over the past three years, however, margins have expanded and asset turnover has only dipped by a few basis points. Source: Lindt & Spr眉ngli 2017 annual report

Source: Lindt & Spr眉ngli 2017 annual report